What Chairman Powell and Dr. Fauci Have in Common: The Nation’s Top Excuse-Makers for Political Sabotage of the Economy

Some recent headlines for your edification:

Astonishingly strong U.S. jobs report sends stocks wavering

Paul R. LaMonica, CNN, February 3, 2023

“US stocks fell Friday after shockingly good job numbers sparked more concerns that the Federal Reserve may need to keep raising interest rates for a longer period of time in order to fight inflation…”

Treasury Yields Fall After Powell Reacts to Jobs Report

Sam Goldfarb, WSJ, February 7, 2023

“Treasury yields are down after Fed Chair Jerome Powell wasn’t as hawkish as investors had feared while discussing monetary policy at an event in Washington.

The 10-year yield was recently 3.627%, according to Tradeweb, down from 3.653% before Mr. Powell started talking…”

Treasury Yields Quickly Bounce Back After Powell’s Remarks

Sam Goldfarb, WSJ, February 7, 2023

“Treasury yields have reversed initial declines after Fed Chair Jerome Powell discussed monetary policy at the Economic Club of Washington. The 10-year yield was recently back up to 3.672% … compared with 3.653% just before Mr. Powell started talking and as low as 3.601% while he was in the middle of his remarks…”

Mortgage rates were falling. The jobs report will likely change that

Anna Bahney, CNN, February 3, 2023

“Mortgage rates will likely rise following the January jobs report shocker, housing experts said Friday. US Treasuries jumped higher after the monthly employment snapshot was released — and where Treasuries go, mortgage rates tend to follow.”

Housing Market Warms Up Amid Drop in Mortgage Rates

Ben Eisen, WSJ, February 7, 2023

“The average 30-year home loan rate has come down by just about a full percentage point…largely in response to signs the Federal Reserve is nearly finished lifting interest rates…”

Dizzy yet?

Let us help:

- Even in 2021 and early 2022, the United States was not experiencing inflation. Inflation is a devaluation of the dollar. The United States experienced price increases because supply shortages from COVID-19 lockdowns ran head on into rising demand as the lockdowns ended. Plus, there was a full-blown, actual war in Europe, and the United States had increasingly cut off its own energy supplies.

- Because there was no devaluation of the dollar, the Fed could not play even a modest role in supporting the dollar. There was no monetary problem for the Fed to solve.

- Chairman Powell’s political power, like Dr. Fauci’s, entirely depends on people believing that (a) there is a crisis for which (b) he is relevant to its solution.

Neither is true. There was no monetary crisis and Chairman Powell and the Fed have been irrelevant every step of the way. Prices went up and then came down — faster than the Fed wants to admit — in a pattern that shows zero influence by the Fed.

Consider a few graphs:

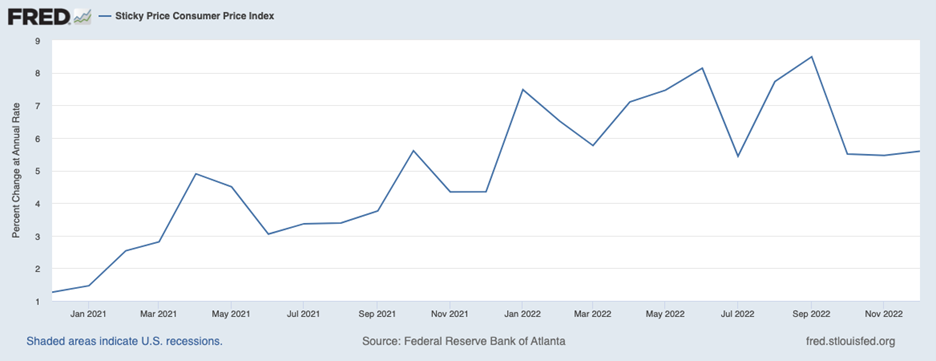

Above is the “sticky” consumer price index for 2021-22. (There are other “un-sticky” versions but all the Consumer Price Index (CPI) graphs have basically the same shape.)

Here is the important point: the chart shows monthly data points, but each monthly point stands for the previous 12 months of inflation, not just what happened that month. These are the figures commonly quoted in headlines that say things like “last month, inflation dropped from 7.5% to 6.8%” never mentioning that the monthly rate approached zero.

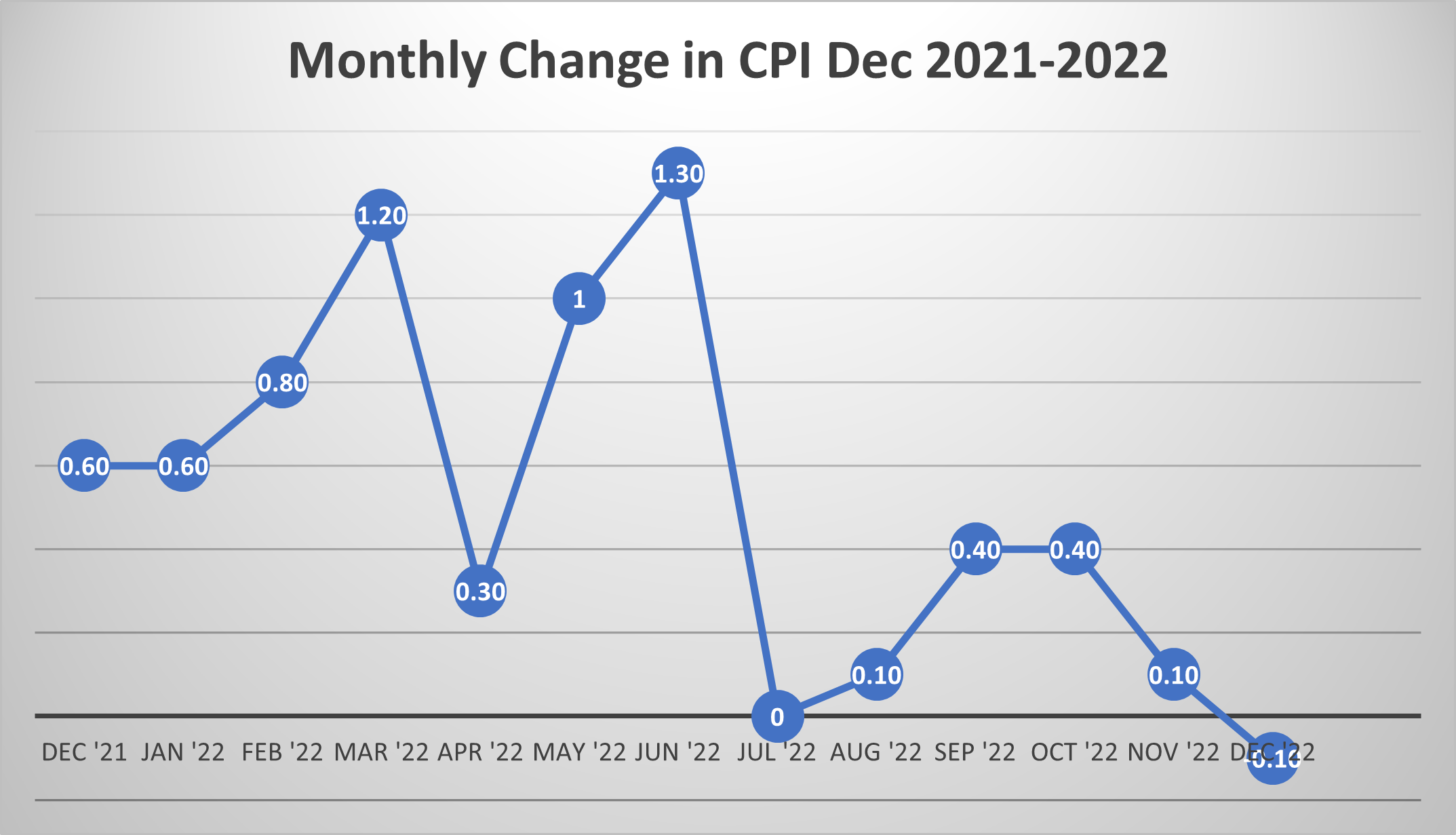

Here is the graph showing actual monthly changes:

Source: Bureau of Labor Statistics

As you can see, the current “inflation” (aka supply-driven price increases) essentially stopped last July. Prices popped back up a little in September and October, but on an annualized basis inflation has been below the Fed’s 2% “target” (as if they had the tools to hit any such thing) for half a year.

Okay, but doesn’t that just mean the Fed did a great job?

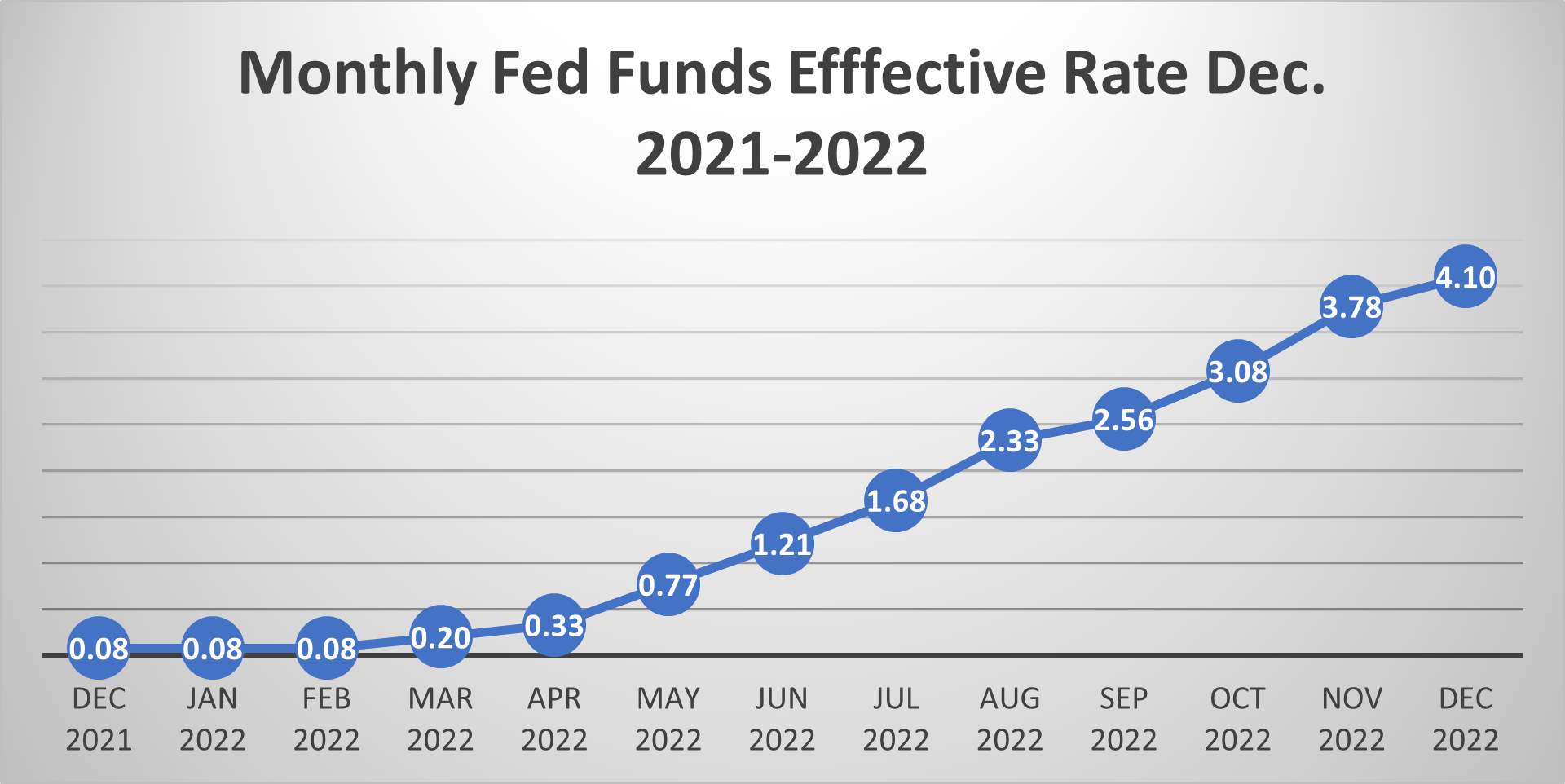

No, it did almost nothing. Look at the final chart, which shows how little the Fed had actually done by the time “inflation” cratered. The Fed barely raised the federal funds rates at all until May, and then only to .77%, so historically low that it might as well have been zero. Even by July, the month “inflation” collapsed, the federal funds rate was still at only 1.68%, still historically low.

Source: St. Louis Fed

Would Chairman Powell dare to claim that he cut the monthly inflation rate from 1.3% (an annualized rate of 15.6%) down to zero in one month by raising rates to a mere 1.68%?

Okay, maybe that’s unfair.

Would he even claim to have reduced “inflation” to 2.25% (the six-month average from July through September) through so paltry and brief an exercise as raising rates to 2.5%?

Of course not.

For one thing he would have to explain why, if his powers are so great, he is still raising interest rates.

If his powers are so great, how did he supposedly let inflation get out of hand in the first place?

The Fed thing, like the smelly mask thing, (and now maybe even the vaccine thing) is a con, enabled in each case by a priesthood generating phony crises, and then, when the crises, inevitably, resolve themselves, taking credit.

The priesthoods are beloved by politicians who use the priests’ pretenses as a dodge to avoid having to find actual solutions to actual challenges. The myth of the Fed’s power excused Biden from any responsibility to explore alternatives (e.g., deregulatory action) to ease the supply chain crisis. With respect to energy, Biden just made things worse. He could get away with it because the rise in gas prices could be blamed on an illusory inflation rather his administration’s decision to bottleneck petroleum production.

The likely outcome of the current cycle is that the Fed will be given credit for ending an inflation that never happened and, even more amazingly, pulling off the heretofore legendary “soft landing.”

Praises will be sung. The illusion that the Fed rules the economy will be ratified. And the Fed will continue to be the all-purpose alibi for awful policies on energy, healthcare, education, bureaucracy, technology, trade, the suicidal hostility to China and everything else that threatens to undermine the American economy.

P.S. Join George Gilder, Steve Forbes and many others at the MoneyShow’s “Global Portfolio Strategy Summit,” Feb. 19-21 in New York City. Our new Publisher, Roger Michalski, has arranged for the first 25 Eagle subscribers who register to attend for FREE! The only way to get a free ticket is by calling 800-970-4355 and mentioning Eagle’s code: 059282. If you aren’t one of the first 25 people, don’t worry. Roger has arranged for you to pay only $99. If you go to the MoneyShow site, you’d pay $299.

Click here now for more details!